At the Budget Jeremy Hunt, Chancellor of the Exchequer, announced his desire to abolish National Insurance. Given that National Insurance was set-up in order to fund the NHS and the other parts of the social safety net created by the post-war Labour Government, and that to this day it’s the only part of the Government’s income that has to go towards funding these services, it’s an ‘interesting’ tax to choose to abolish.

Having already now National Insurance at the Budget and the previous Autumn Statement–cutting the budget reserved for the NHS and similar services in the process, with a General Election pending and a further fiscal event before the election now being scheduled, why would a Chancellor moot such a plan without having any interest in carrying it forward?

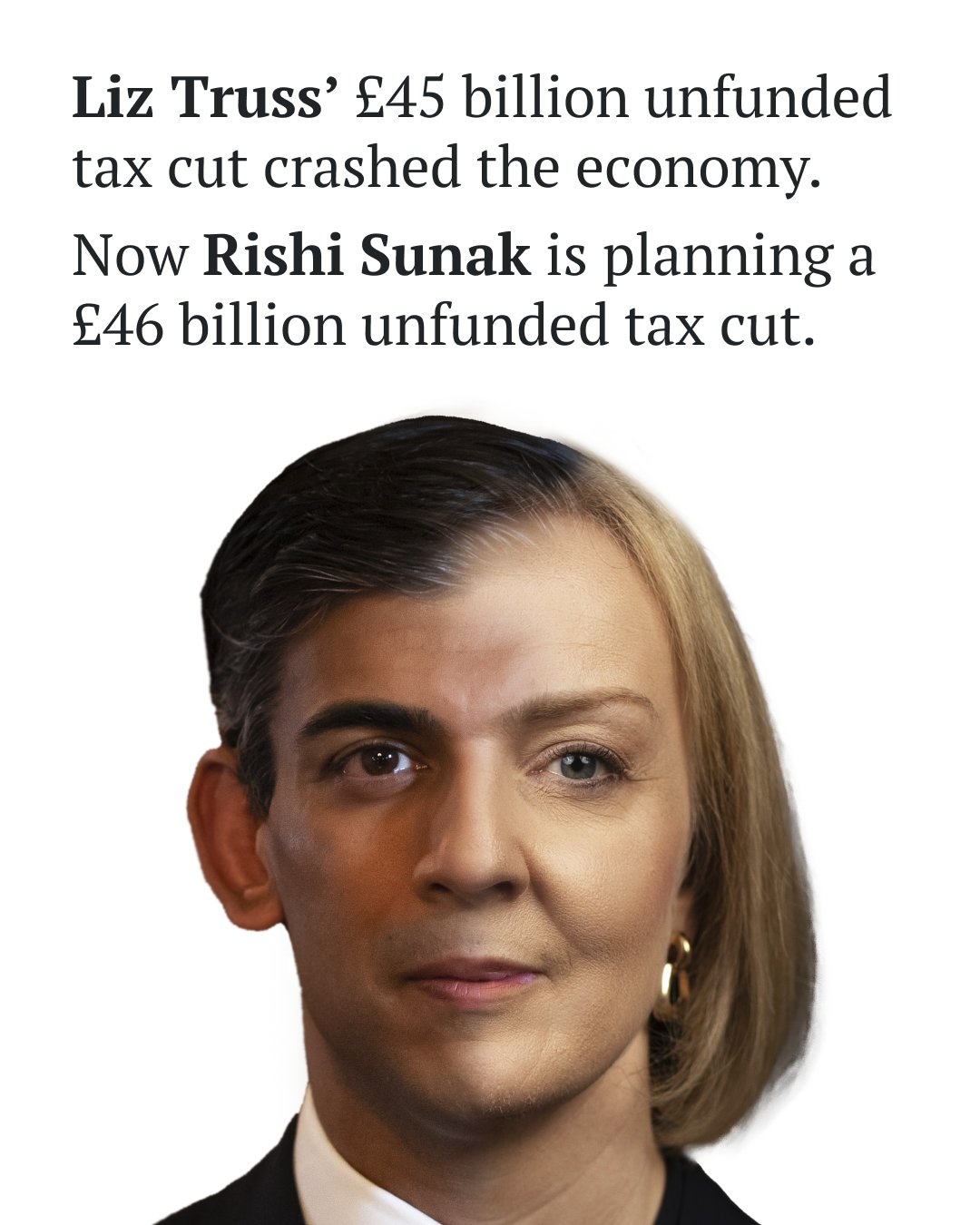

Let’s be clear what that would mean. Ending National Insurance would open up a £46bn hole in Government revenue (roughly 1.7% of the UK’s GDP), which would then need to either be funded by tax cuts or by increased borrowing.

In terms of cuts, it’s a huge sum and comes after 14 years of cuts which have left most public services on the brink of collapse. The Conservative Chancellor’s proposal would be the equivallent of abolishing the UK’s armed forces in terms of expenditure. The Jeremy Hunt refused to rule out making up the gap by increasing taxes on pensioners when asked directly by the Shadow Chancellor.

The picture isn’t much better when it comes to borrowing. Liz Truss almost collapsed UK pensions and kicked off rampant inflation by announcing tax cuts funded by borrowing in her disaster budget, the effects of which we’re still living with now. Economists estimate the impact would be increasing inflation by almost a percent, the equivalent of adding an extra £220 onto the cost of the annual weekly shop every year. The impact upon interest rates would add £275 onto monthly mortgage payments for the average UK house.

Clearly, this is a Government unwilling to learn from past mistakes or the polling which repeatedly shows the public would value better public services over cuts to taxes. Only economic growth can square this circle, increasing household incomes while growing government revenue to enable better public service spending.

Tax cuts will just increase inflation, we need both public sector investment in national infrastructure and skills, and to attract the private sector investment which has fled Britain for fourteen years due to the chaotic economic policies and instability in Government of the Conservatives.

In contrast, Labour will get Britain building again, energise the Green economy, and unleash the skills of the British public by breaking down the barriers to opportunity. It’s time to get Britain’s future back, it’s time for a General Election.

Discover more from Peter Lamb for Crawley

Subscribe to get the latest posts sent to your email.