At 10.30am this morning, West Sussex County Council will be meeting to agree their budget and set their share of council tax for the next year.

It’s fair to say that I’m not a fan of the County Council. In my experience, despite many incredibly dedicated and hard-working members of staff, the structure itself is pretty dysfunctional and out-of-touch with Crawley’s needs. It’s not hard to see why, for all the talk of devolution meaning decisions being taken closer to home, Chichester is actually further from Crawley than Westminster geographically, not to mention socially, economically and culturally as well.

I expressed these feelings quite clearly over the four years I served as a county councillor, during which time I acted as the Labour Group’s portfolio-holder for Performance and Finance, a role which involved scrutinising the council’s finances.

Despite leaving the council seven years ago, I have continued to consider the budget paperwork each year to understand how decisions being taken in Chichester stand to impact upon Crawley’s community.

This year, WSCC’s budget for services can be roughly summed up as having rising demand and costs which will need to be addressed through:

- Council tax going up by 4.99%

- Use of £3.6m worth of reserves

- Budget cuts of £15.7m

Let’s look at each of these in turn.

That 4.99% council tax increase represents an extra £81.51 on the bill for a band D property, that’s on top of the Police and Crime Commissioner meeting a few weeks back agreed a council tax increase of £13 (5.4%). By way of comparison, when Crawley Borough Council sets its budget later this month, the proposed increase is a comparatively minor 2.99%, or just £6.76 per year. As usual, it’s the tier of government in the area run by Labour which delivers the best value for money. So, when Crawley Borough Council send you a council tax demand for £2,199.93 later in the year, just bear in mind that the borough council only keeps £232.10 of that bill, while 78% of the tax goes to West Sussex County Council and 12% to the Police and Crime Commissioner .

On the use of reserves to prop up the budget for services, this isn’t a long-term solution, but when redesigning services, waiting for new income streams to come online, or dealing with one-off pressures then using reserves is often the sensible choice when compared to cutting a service one year only to reinstate it in the next.

Which leaves the budget cuts, a breakdown of which can be found here. While the wording of each option is designed to obscure as far as possible what each cut entails, the reality is that behind the wording is elderly residents missing out on care packages, vulnerable children’s needs going unmet, and roads being allowed to decay further.

No council should be having to make such ‘efficiencies’, but it has been a basic principle of my approach over the years not to complain about a proposal unless I can propose a better alternative and the simple fact is that at this point councils across the country are almost out of options.

Even before Austerity, councils were the most efficient part of the public sector (something David Cameron himself highlighted while in opposition) and since that time we have faced the harshest cuts of any part of the sector, the reality is that there is only so much cloth you can cut. It is increasingly clear that if local government is to survive as a concept we are going to need a change of Government.

That isn’t to say that the Conservatives running West Sussex didn’t help to dig the hole the council is now in: prioritising cuts over generating income and thereby reducing their options for the future, selling off all their care homes to leave budgets at the whims of the market, the Capita outsourcing deal which deskilled the organisation and upped failure demand significantly, and lastly a county council leader who managed to take the authority from debt-neutral to half a billion pounds of debt during a period where the council’s grant from central government increased each year. That councillor’s name was Henry Smith.

If they had instead avoided handing out hundreds of millions of pounds on bad outsourcing contracts and looked to invest to generate new income like Crawley Borough Council has under Labour, the council would be much better placed to weather the storm. It’s not as though the opportunities aren’t there, I have written previously about the obscene amount of vacant property West Sussex has had sat decaying for years, sometimes decades.

Which is to say that while the current and past Conservative administrations at West Sussex carry a huge amount of responsibility for the financial challenges facing the council, but as all of this is now baked-in and the Conservatives in Parliament continue to ignore the risks of starving councils of funding, much of the problems are baked-in, leaving little room for alternatives.

All that being said, West Sussex County Council does seem to be determined to make the authority’s problems worse for the future, as we can see by looking at their proposed capital budget.

I forget the precise year, but it was during my time on the council, the Conservatives agreed a gigantic capital programme. The rumour at the time was that the Leader was simply unable to control their group enough to produce a targeted plan and instead chose to reinforce their position and just letting Conservative councils fill the programme up with their pet projects. Lacking the capital reserves that generations of Labour councillors had put aside at Crawley, I pointed out at the time that they would be taking on a phenomenal amount of debt and would in the process be preventing any future generation from being able to spend capital to meet their own needs.

Here we are two county council elections later and there are very few familiar faces left at Chichester. How many of these pet projects of former councillors sit on the programme today, with no one knowing why they’re on the list or if they are even still wanted by the local community, but sat like a hand grenade ready to blow the debt up further?

Worse, at the time that the plan was agreed, interest rates were at a historic low (0.25-0.5%). We now find ourself facing the highest rates in sixteen years (5.25%) and under much worse economic conditions , so the cost of financing that capital plan has grown enormously.

Despite this, the council continues to add to the programme and the end result is now a programme which will roughly double current debt-levels, approaching a billion pounds of debt and with a 40-year payback period.

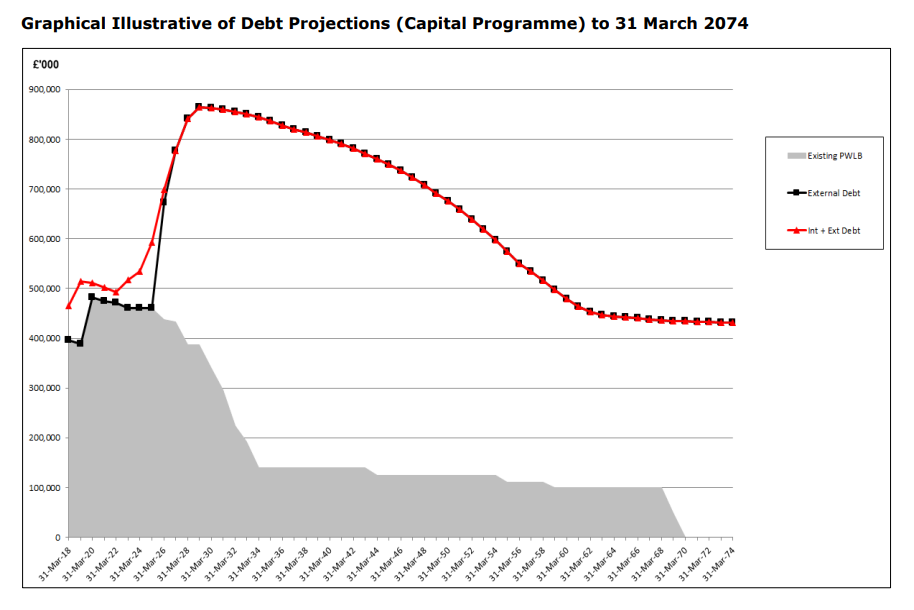

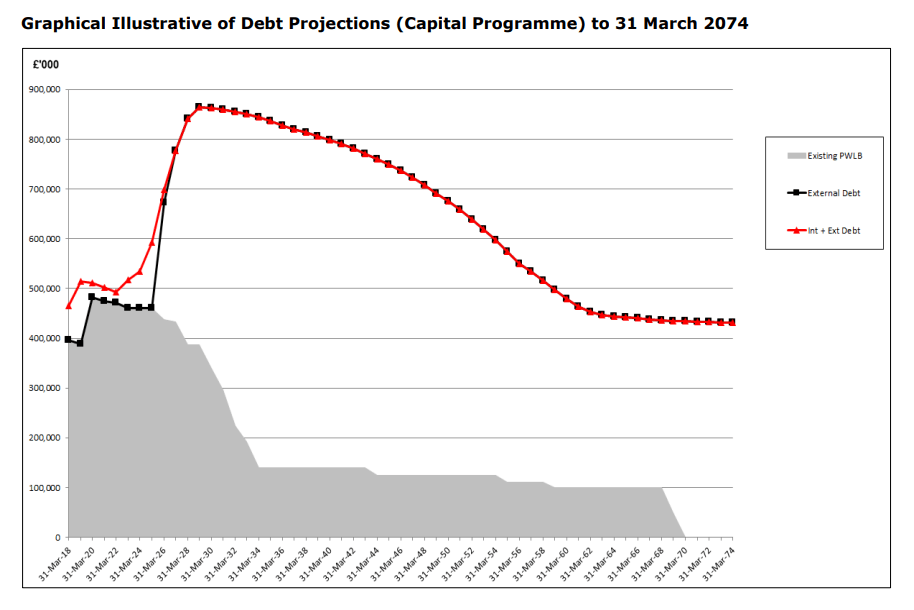

The graph below shows what this looks like, with a rapid growth in debt over the next couple of years, which then declines and finally levels-out in around 2064, at which point ongoing borrowing to fund capital expenditure roughly matches what is being paid off each year.

Very few current county councillors will still be alive in 2064, but by maxing out the credit card now they are binding the hands of the next two generations of county councillors. Had councillors in the 1980s taken this approach we would only now be able to consider significant capital investment, consider how far residents’ needs and infrastructure has changed in that timespan. It leaves the county extremely vulnerable to changing circumstances.

Next there’s the impact upon the council’s budget for services, as the council has to pay off the capital debt from the General Fund and given existing pressures on this budget, things are only going to get harder. All-in-all, the planned borrowing is going to have an impact of us paying £50m or a full 6.5% of Net Revenue Expenditure each year, stretching off into infinity on the graph, to fund the capital programme.

Were the council to choose to reduce the scale of its capital programme it would reduce the debt, but that wouldn’t mean a total absence of capital expenditure, as around 40% of the projected sources of revenue come from sources other than debt. So, while it might be hard to scale back the capital programme, it wouldn’t be the end of investment in our local infrastructure.

Lastly, it should be noted that the council is making a big mistake in seeking to use capital reserves to pay for revenue costs. Ordinarily there are rules to both ban the use of capital reserves to pay for services and to prohibit borrowing to pay for day-to-day services. The reason for this is a desire to avoid councils getting themselves into the most dire financial circumstances by racking up debt for transient expenditure or selling off all their assets to maintain service spending without balancing budgets.

However, rather than dealing with the underlying issues in local authority funding, the council is allowing some revenue expenditure to be paid for out of capital and in the process opening the floodgates to financial irresponsibility. So, more of the same from West Sussex.

Discover more from Peter Lamb for Crawley

Subscribe to get the latest posts sent to your email.