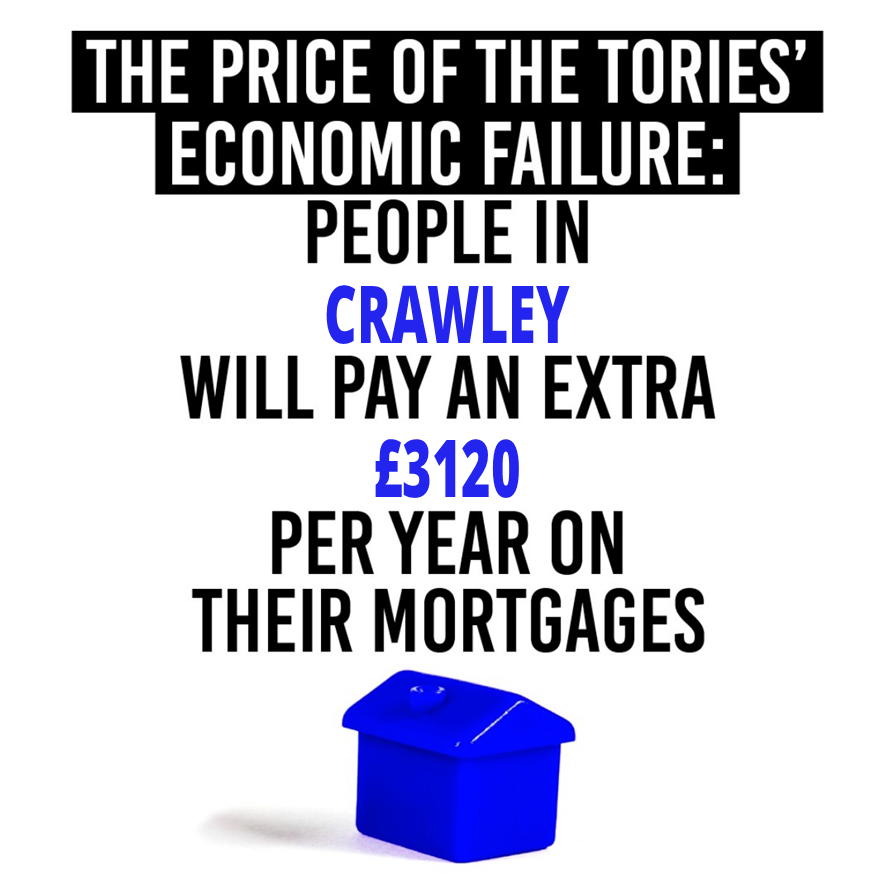

With interest rates at 5.25%, there are currently 15,000 families in Crawley who are facing an average £260 increase on their monthly mortgage payment. What residents in Crawley, and across the UK, desperately need is a Government plan to ease the hit from soaring mortgages and to halt repossessions.

This lack of action can be seen in the fact that mortgage costs in the UK are higher than those in other advanced economics – leaving households in Britain paying more in mortgage payments than households in Germany, France, the Netherlands and Ireland. This gap in mortgage rates means that a typical British household is now paying £1,000 more on their mortgage per year than our neighbours.

While the Conservatives are unwilling to act, Labour has set out a five-point plan to ease the Tory mortgage penalty and is calling on the government to urgently adopt their plan and introduce measures:

- Requiring lenders to allow borrowers to switch to interest only mortgage payments for a temporary period.

- Requiring lenders to allow borrowers to lengthen the term of their mortgage period.

- Requiring lenders to reverse any support measures when the borrower requests.

- Requiring lenders to wait a minimum of six months before initiating repossession proceedings.

- Instructing the FCA to urgently issue consumer guidance stating that borrowers making temporary switches to interest only mortgage payments and lengthening the term of their mortgage period should not see their credit score affected.

Labour have also said they would bring in a Renters’ Charter ending ‘no-fault’ evictions and introduce four-month notice periods for landlords.

The party say that their long-term plan to bring fiscal responsibility and stability back to the UK economy – through strong fiscal rules, respect for economic institutions and Office for Value for Money – will also play a vital role in getting inflation and interest rates down.

Moneyfacts data suggests the typical rate on a two-year fixed-rate loan had increased to above 6%, almost the rate double a year ago, and the Resolution Foundation estimates that 6.5m households will be affected by the post-mini budget rise in mortgage rates by 2026.

Discover more from Peter Lamb for Crawley

Subscribe to get the latest posts sent to your email.