As an elected representative, you end up on a lot of mailing lists. Some you sign-up to, many–if not most–are lists other organisations have signed you up to. Much as with the ASDA household incomes tracker, I can’t recall if I actively signed-up to SHW’s quarterly reports of activity in the local property sector, but it is sufficiently interesting to have avoided my regular mailing list cull.

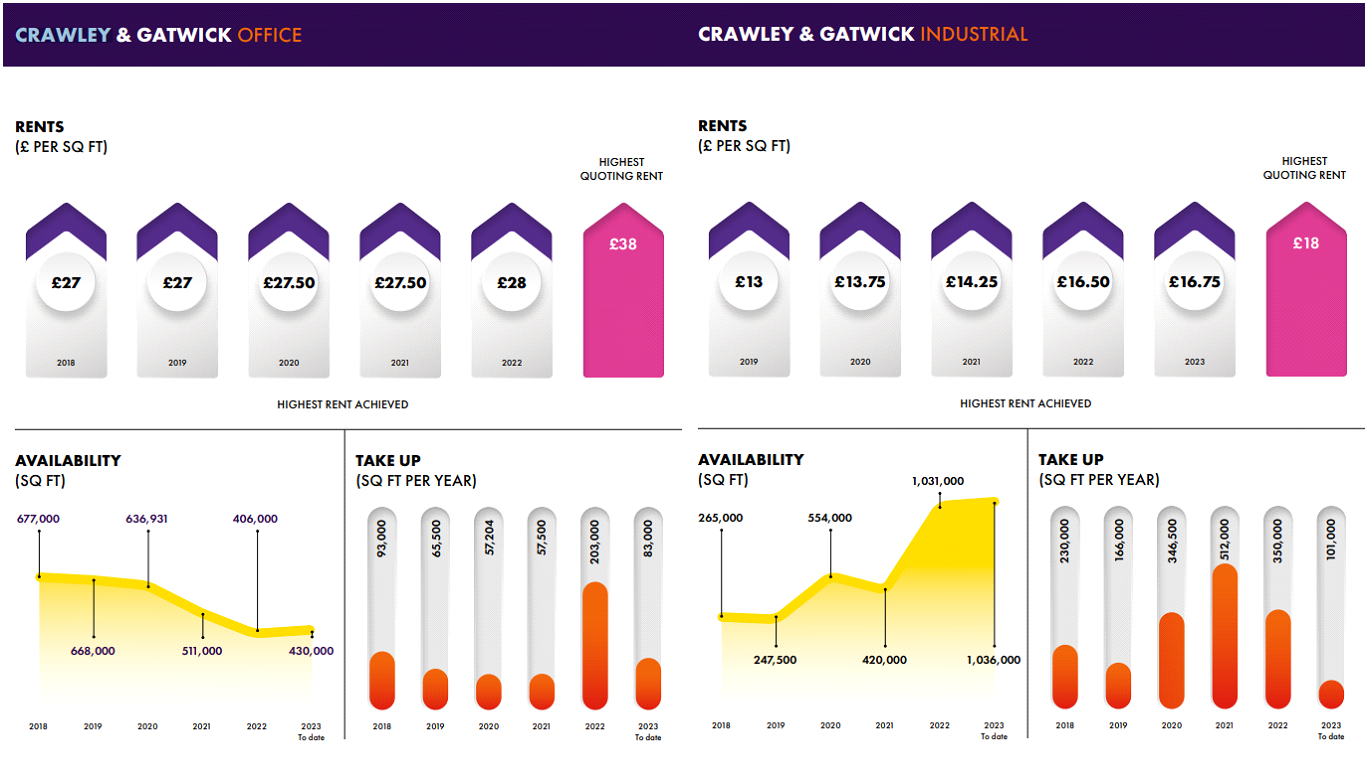

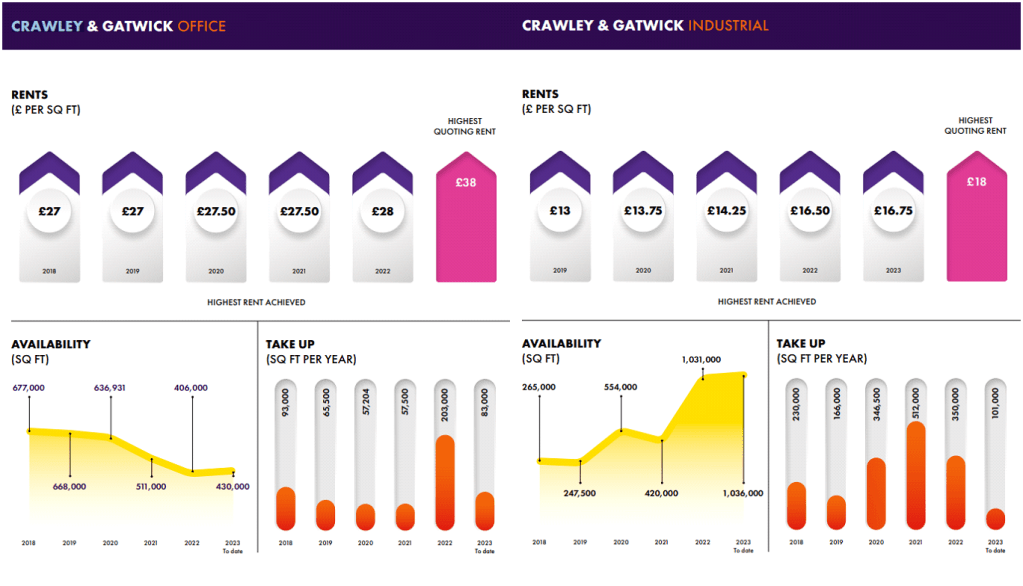

At the start of the year, the demand for office space in Crawley appeared to be growing and the demand for industrial space shrinking, despite a decline in office space supply and an increase in industrial space supply.

By Q3, availability of both office and industrial space appears to have stabilised, with demand appearing to be behind that recorded last year and a bigger drop-off in demand for industrial space. Meanwhile the maximum quoted rents for both having gone up by around 9%.

While the vacancy rate for office space in Crawley is greater than that of industrial space (14.8% and 8% respectively), given the higher rent levels it continues to seem strange to me that employers have opted to sacrifice office space for warehousing. Given the time lag from a decision being taken around the redevelopment of a site and that site actually coming to market, perhaps this reflects assumptions made during the pandemic that remote working out put an end to the need for office space? If so, I guess we’d expect to see a growth in new office space over the next few years as subsequent investment decisions are realised.

The other thing which seems worth remarking about is local retail rents, where prime rents in Crawley are not only higher than all other areas in the sub-region, but in our section of the South East only London, Brighton and Chichester appear to do better.

Truth be told, I suspect that this isn’t a good thing. Rent levels reflect what tenants are prepared to pay for a unit, but just because some tenants can afford that rent level doesn’t mean that every business we might hope to see in the town centre can afford it. Certainly, it’s likely to reduce the number of people who can afford to take a risk by opening an independent store. So, instead of a wide range of retail options, you end up with a town centre filled with cafe chains selling expensive coffee.

This clearly isn’t the only issue, globally high street retail is continuing to struggle to the internet, but price gouging certainly doesn’t help and when property owners can already claim premium rents on 1950s buildings, there’s a lack of incentive in ensuring these units better meet retailers’ needs.

Unfortunately, the council doesn’t own any town centre shop units and has no direct influence over their rent levels. Local authorities don’t even control the price at which business rates are set. Leaving very few options for addressing these problems as things stand.

Fortunately, the Labour Party has already committeed to replacing business rates with a system which better reflects the changing balance between hgih street retail and internet shopping (something I have been calling for well over a decade now), and introduces new powers for councils to do things such as enabling local authorities to step-in to ensure vacant units are filled.

The town centre has changed a lot since it was first permitted to hold a weekly market in 1203, it will go on changing as society and technology continues to evolve. Yet, with changes like the Labour Party is proposing, for the first time in a long time I am starting to believe that retail may yet have a future in UK town centres.

Discover more from Peter Lamb for Crawley

Subscribe to get the latest posts sent to your email.